Australian Dollar rises … did you hedge your International exposure?

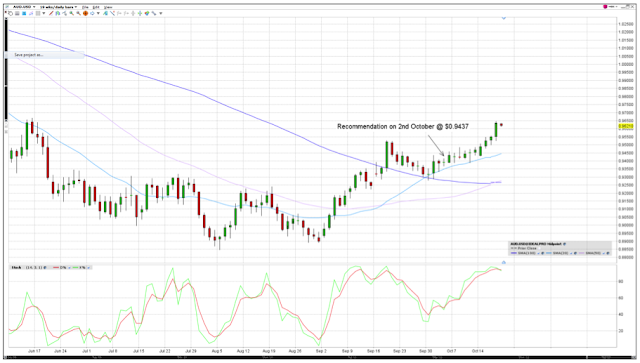

On the 2nd October, we recommended to traders who trade US positions, to adopt a Currency Hedge as the Risk of a rising Australian dollar had increased. For traders who participate in US trades, if the Australian dollar rises, the value of the US dollar based positions will decrease.

At close of Thursday in the US, the Aussie Dollar was at $0.9633 – a gain of 2.02% in only 2 weeks.

What this means, is that if you had made 2% on your portfolio in your US trades, this would be negated by the currency change.

Our analysts are evaluating on a daily basis whether or not the need to hedge against a currency change is required. There’s no point giving back what we make in the markets, when we can easily hedge against a rise in the dollar. It’s the reason why it is so important that when you receive the alert, you contact the broker and place the position.

If you trade in US positions, contact the brokers on 1300 304 500 today to discuss placement of a Currency Hedge.

To subscribe to 7 day free trade recommendations click here

Comments

Post a Comment